Why Furniture Retailers Need to Step Up Their Online Game

Explore why furniture retailers must elevate their online strategies and how they can thrive in the digital marketplace.

The volume of online shopping done by Americans has skyrocketed in recent years, fueled by a global pandemic and technological advancements — but it hasn't always looked this way for the eCommerce sector.

Online retail is actually a relatively new form of doing business and the Census Bureau only began tracking the industry segment in a standardized format this year. The first true eCommerce company goes back to 1969, but it looked a lot different than the click-to-buy, frictionless convenience we know today. Named CompuServe, the company was the oldest of the early internet service providers (another was America Online, which acquired CompuServe in 1998). By the summer of 1995, Jeff Bezos had launched a service for buying books over the internet. In its first 30 days of operation, the company made sales in 50 states and 45 countries — and thus, Amazon was born.

In this article, we'll take you through some eCommerce charts that track the growth of eCommerce throughout this century to highlight its incredible growth.

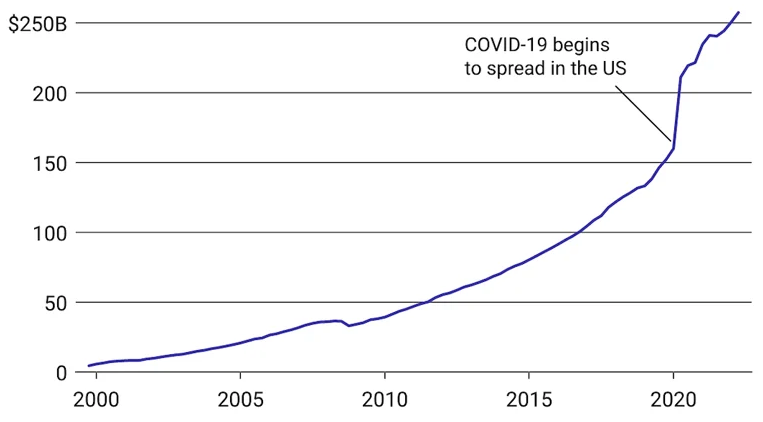

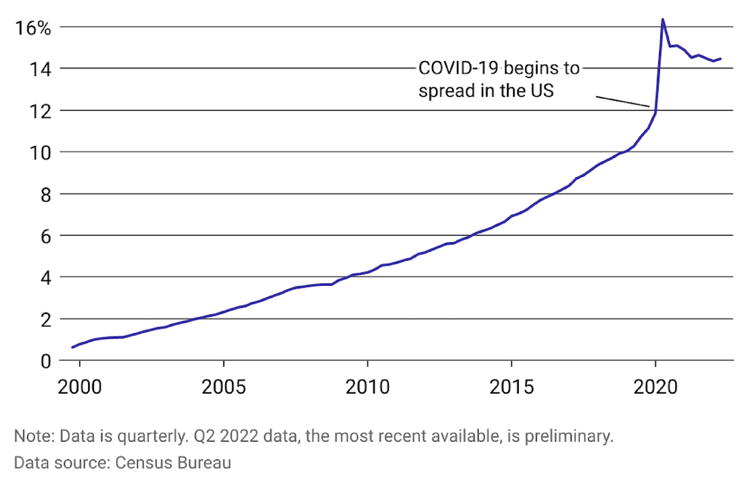

Now, online shopping is as simple as a few taps on a smartphone, and it represents 14.5% of all retail sales. eCommerce retail sales hit about $960 billion in the U.S. in 2021, and Americans are on track to exceed that with nearly $508 billion in sales through Q2of 2022 alone, according to U.S. Census Bureau data. American shoppers spend an estimated $2.85 billion online collectively each day.

To gain more insight into this online evolution, Ironplane compiled data from Census Bureau's Annual Retail Trade Survey (ARTS) and the Quarterly eCommerce Report subset to showcase how eCommerce has grown over the past two decades (as a survey, all numbers provided by ARTS have a margin of sampling error). Read on to learn how the evolution of the internet has changed the way humans shop.

Before people headed online en masse due to COVID-19 social distancing and public health concerns, eCommerce had already been experiencing rising sales. In the early 2000s, a flurry of traditional retail giants — including Walmart, Costco, and Safeway — launched websites for online sales, spurred by a healthy fear of Amazon's early dominance. And despite a dip in sales during the Great Recession, eCommerce activity increased each year at a relatively steady pace.

Throughout the 2010s, retailers pared down brick-and-mortar store locations while investing in fulfillment services and acquiring tech platforms to support eCommerce operations. In 2013, office supplies retailer Staples, for example, saw in-store shopping habits shift online to such an extent that its executives buckled down to "fundamentally reinvent" the company. This plan included shuttering hundreds of store locations.

Roughly 3 in 20 retail purchases made in the U.S. are online, and for much of the last two decades, online shopping has seen its share of the market grow steadily... until the pandemic arrived, that is.

The onset of the COVID-19 pandemic caused Americans to desert public spaces — an act that supercharged online shopping in 2020. While some retail executives and industry analysts predicted that the trend toward online shopping was here to stay, online sales began to dip by fall 2020, showing that the trend wasn't as sticky as they may have believed. eCommerce’s portion of market share has dropped, though it’s still slightly higher than before the pandemic.

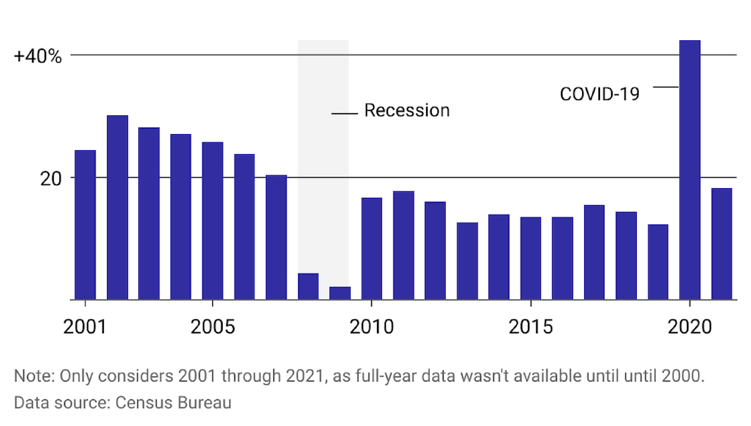

Retail sales in eCommerce have grown every year since at least 2001, but that growth has been inconsistent.

The first ever "Cyber Monday," the online shopping holiday that falls the Monday after Thanksgiving, happened in 2005. But even the widespread popularity of the new holiday couldn't match the boost the COVID-19 pandemic provided to eCommerce shopping growth when measured yearly. Growth tapered during the Great Recession as American households pulled back on spending, and began to recover in the 2010s, though it did not reach early industry growth levels until 2020.

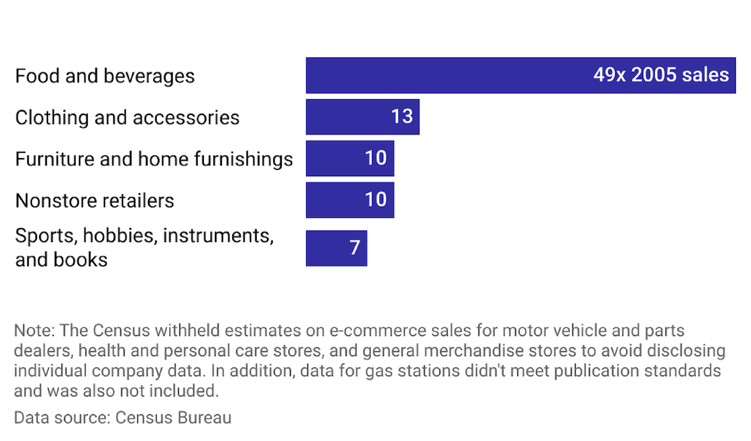

Let's examine the store types with the most eCommerce growth from 2005 to 2020 in this graph — note that the Census withheld estimates on eCommerce sales for motor vehicles and parts dealers, health and personal care stores, and general merchandise stores to avoid disclosing individual company data.

Online food and beverage sales, including grocery and restaurant delivery, have been the fastest-growing segment of eCommerce sales since 2005. Americans spent $23 billion collectively on grocery and food delivery in 2020, up from $8.5 billion in 2019. Clothing and wearable accessories saw the next largest boost in 2020, bringing in $16 billion — up from $12.5 the previous year.

Here are some general eCommerce trends and forecasts to keep an eye out for in 2024:

It's also worth considering some digital trends and practices that will continue to rise in 2024 and onward:

Businesses that embrace these trends and practices will be well-positioned to succeed in the eCommerce landscape in 2024 and beyond.

Explore why furniture retailers must elevate their online strategies and how they can thrive in the digital marketplace.

Explore the resale and recommerce industry, its disruptive impact on retail, and how businesses can leverage it to create thriving secondhand marketplaces.

Ironplane compiled a list of five technologies that have improved e-commerce outcomes for businesses and consumers.